Table of Contents

- 2024 - Maximum TSP/401k and IRA contributions - YouTube

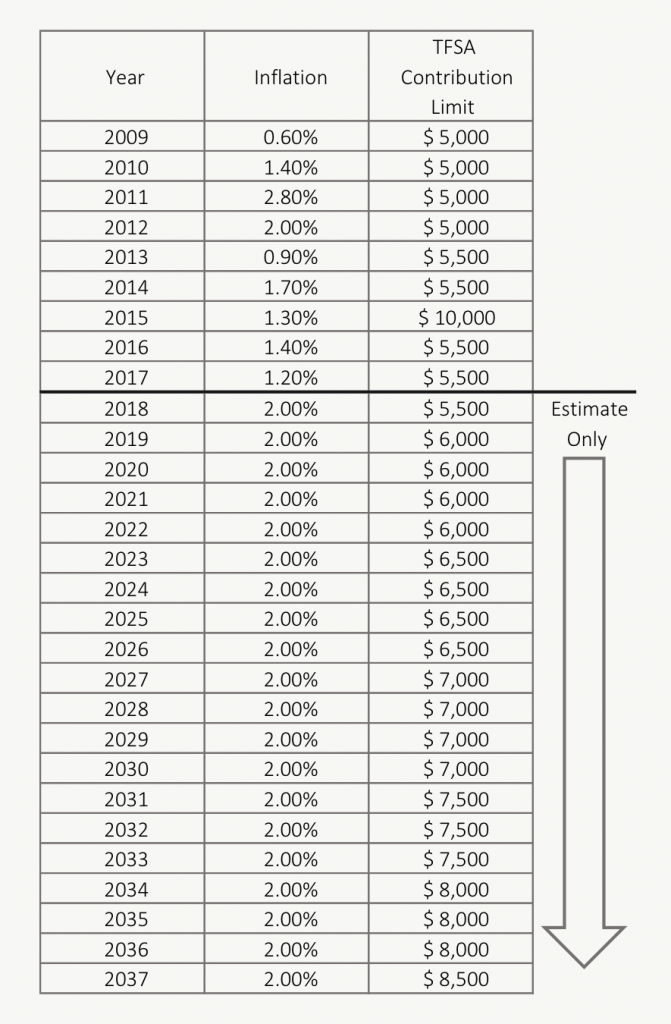

- Tfsa 2024 Contribution Limit - Deeyn Evelina

- 2024 Tfsa Maximum Contribution - Dede Monica

- 401k Limit 2024 After Tax Calculator - Grete Austina

- 2024 TFSA Contribution Limit Misunderstandings

- IRA Archives - Self-Direct your IRA

- Irs 401k Limits 2024 - Orly Candida

- Tax Changes You Should Know for 2024: 401(k) Limits, Tax Brackets and ...

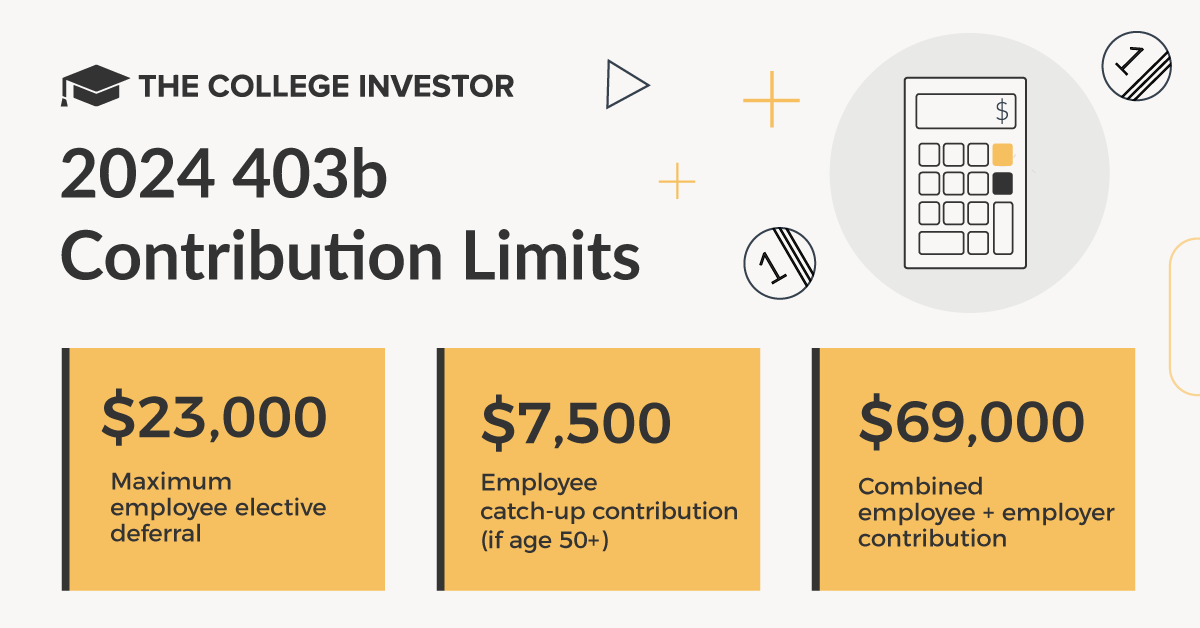

- Here's the Latest 401k, IRA and Other Contribution Limits for 2024

- New IRS Limits for 401k and IRA: Maximize Your Retirement Savings - YouTube

What are 401(k) Catch-Up Contributions?

2025 Updates

2026 Updates

Looking ahead to 2026, the IRS has announced the following updates: The standard annual 401(k) contribution limit is expected to increase to $23,000, up from $22,500 in 2025. The catch-up contribution limit for individuals aged 50 or older is expected to increase to $8,000, allowing for a total annual contribution of $31,000 ($23,000 standard limit + $8,000 catch-up limit).

Key Considerations

When planning your 401(k) catch-up contributions for 2025 and 2026, keep the following points in mind: Age eligibility: You must be at least 50 years old to make catch-up contributions. Contribution limits: Be aware of the standard annual limit and the catch-up limit to avoid exceeding the total allowed contribution. Tax implications: Contributions to a traditional 401(k) plan are made pre-tax, reducing your taxable income for the year. However, withdrawals are taxed as ordinary income. Roth 401(k) options: If your employer offers a Roth 401(k) plan, you can make after-tax contributions, which can provide tax-free growth and withdrawals in retirement. 401(k) catch-up contributions offer a valuable opportunity for older workers to boost their retirement savings. By understanding the updates and limits for 2025 and 2026, you can make informed decisions about your 401(k) plan and maximize your benefits. Remember to review your individual circumstances, consider your overall financial strategy, and consult with a financial advisor if needed. Start planning today to make the most of your 401(k) catch-up contributions and secure a more comfortable retirement.Disclaimer: The information provided in this article is for general purposes only and should not be considered as professional advice. It's essential to consult with a financial advisor or tax professional to determine the best course of action for your individual circumstances.