Table of Contents

- 3 Oil Stocks To Watch Today | Nasdaq

- Occidental Petroleum (OXY) Stock Analysis: Should You Invest? - YouTube

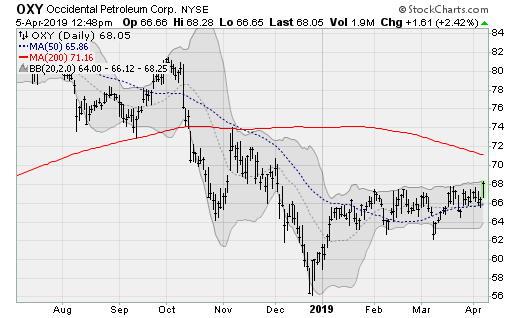

- 5 Top Stock Trades for Monday: JD, NVTA, SBUX, SPOT, OXY

- 4 Top Stock Trades for Monday: ZS, CGC, OXY, UBER

- Occidental Petroleum (OXY) - stock value investment analysis (weekly ...

- OXY | Free Stock Chart and Technical Analysis | TrendSpider

- 3 Quality Stocks On Track for Significant Dividend Increases

- Occidental Petroleum Corporation: Must Know Things for OXY Stock: Guest ...

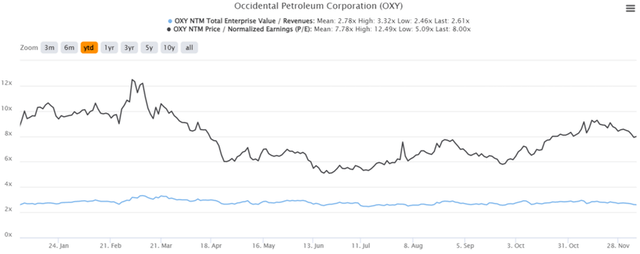

- Occidental Petroleum's Premium May Be Too Optimistic (NYSE:OXY ...

- OXY Stock Price and Chart — NYSE:OXY — TradingView

Current Market Trends

Factors Influencing Occidental Petroleum's Stock Price

Future Outlook

Looking ahead, Occidental Petroleum's stock price is expected to continue to be influenced by the factors mentioned above. However, the company is taking steps to position itself for long-term success. Occidental Petroleum has announced plans to invest in renewable energy sources, such as solar and wind power, and has set targets to reduce its greenhouse gas emissions. In addition, the company has a strong track record of delivering returns to shareholders, with a dividend yield of around 5%. This makes Occidental Petroleum an attractive option for income-seeking investors. In conclusion, Occidental Petroleum's stock price is influenced by a complex array of factors, including global oil prices, production levels, geopolitical events, and environmental concerns. While the company faces challenges in the ever-changing energy landscape, it is taking steps to position itself for long-term success. As the energy sector continues to evolve, it's essential for investors to stay informed about the latest trends and fluctuations in Occidental Petroleum's stock price. By tracking the trends and analyzing the factors influencing the stock price, investors can make informed decisions and potentially capitalize on opportunities in the energy sector.For the latest updates on Occidental Petroleum's stock price and other market news, visit Markets Insider.

Note: The stock price mentioned in this article is subject to change and may not reflect the current market price. It's always recommended to consult with a financial advisor or conduct your own research before making investment decisions.