Table of Contents

- Premium Vector | Tariff vector outline doodle Design illustration ...

- Trump tariffs explained: Where things stand with Mexico, Canada, China

- Tax vs Tariff-What is Tariff?What is Tax?Difference Between Tariff &Tax ...

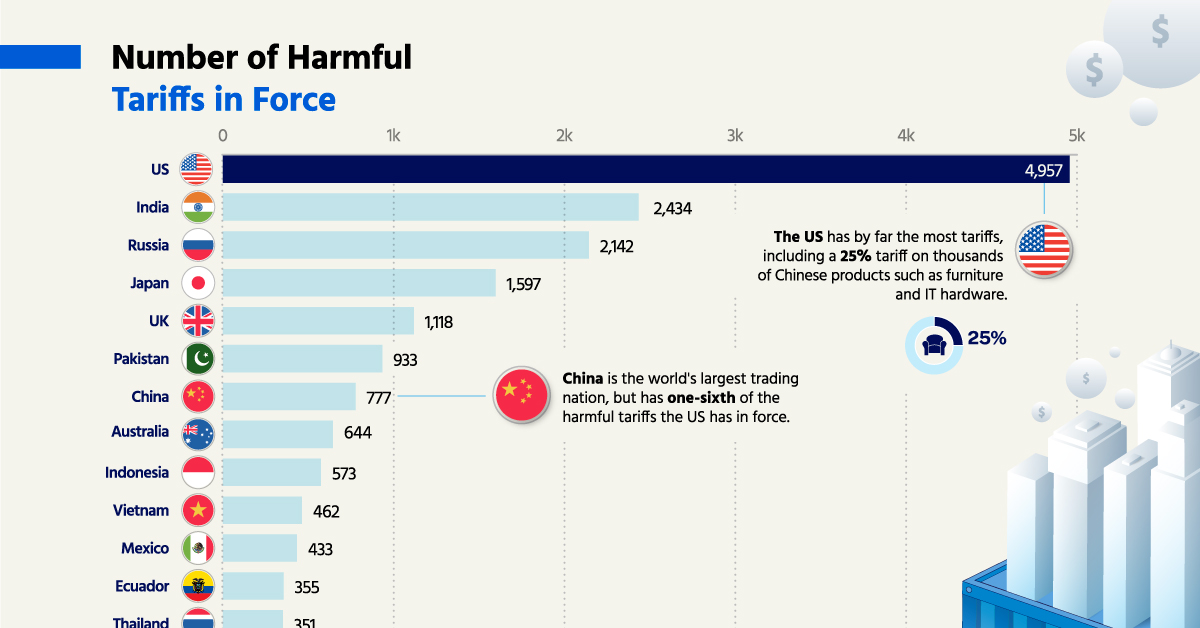

- Ranked: Harmful Tariffs by Economy

- Tariffs Definition Examples Pros And Cons - vrogue.co

- What is the significance of tariffs? | Live Index

- What Is a Tariff and How Does It Work? A Guide | CentSai

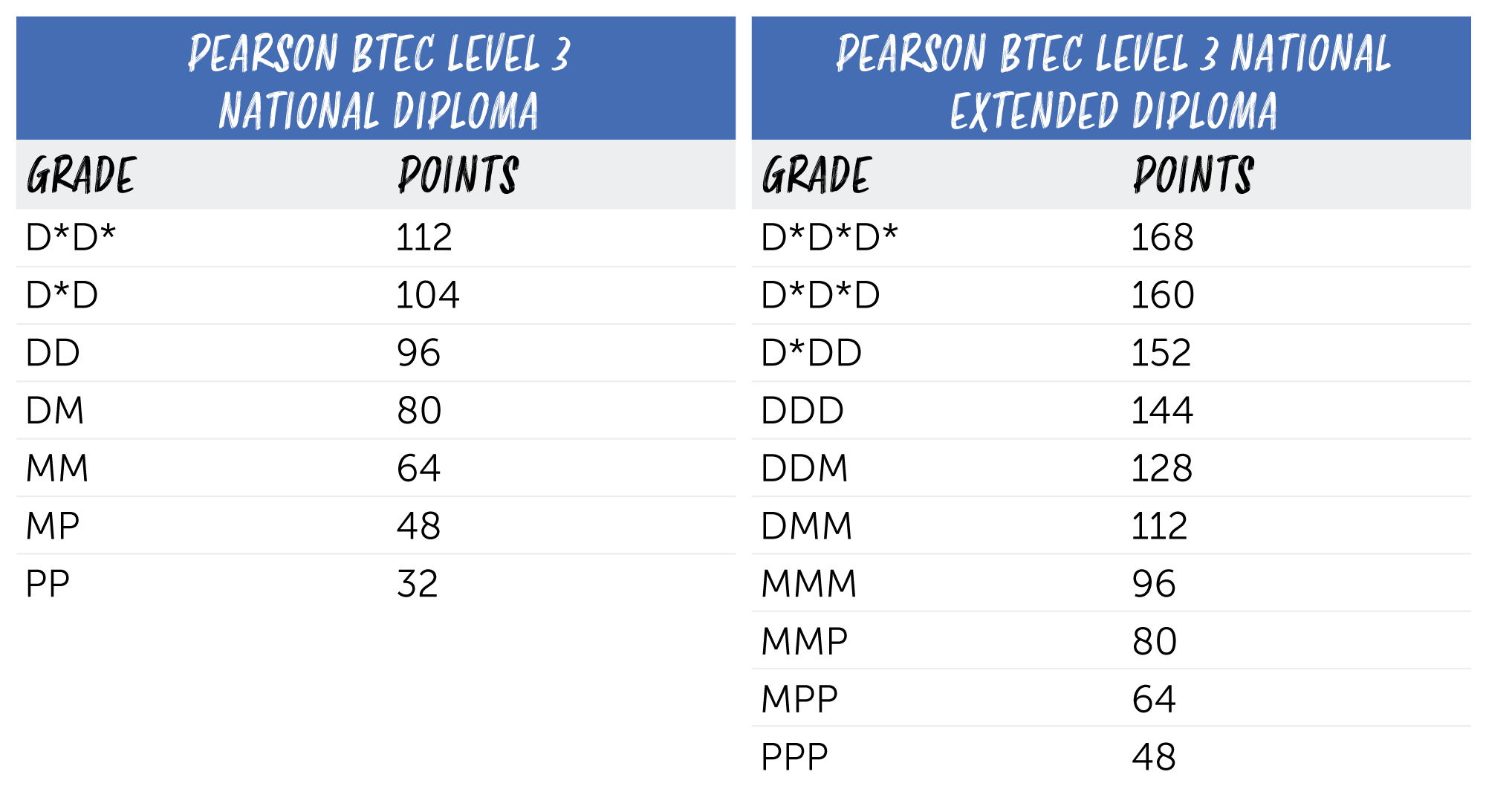

- UCAS Tariff Points - A Simple Guide | StudentCrowd

- Tariffs+vs+Taxes | Small Business Sense

- PM approves first-ever National Tariff Policy - LEAP Pakistan

What are Tariffs?

Who Pays for Tariffs?

Who Benefits from Tariffs?

Tariffs can benefit domestic industries by making imported goods more expensive and less competitive. This can lead to an increase in demand for domestically produced goods, which can boost production, employment, and economic growth. Additionally, tariffs can generate revenue for governments. The revenue generated from tariffs can be used to fund public goods and services, such as infrastructure, education, and healthcare. However, tariffs can also have negative effects on the economy. They can lead to higher prices for consumers, reduced competition, and decreased economic efficiency. They can also lead to retaliatory measures from other countries, which can escalate into trade wars. In conclusion, tariffs are a complex and multifaceted issue that can have far-reaching effects on international trade and the economy. While they can benefit domestic industries and generate revenue for governments, they can also lead to higher prices, reduced competition, and decreased economic efficiency. As the global economy continues to evolve, it's essential to understand the ins and outs of tariffs and their impact on international trade. By understanding how tariffs work and who benefits from them, we can better navigate the complexities of international trade and work towards creating a more equitable and efficient global economy. Whether you're a business owner, a consumer, or simply someone interested in international trade, it's essential to stay informed about tariffs and their effects on the economy.Keyword density: Tariffs: 12 instances International trade: 4 instances Economy: 6 instances Trade barrier: 1 instance Importer: 2 instances Consumer: 3 instances Domestic industry: 2 instances Government: 2 instances Revenue: 2 instances