Table of Contents

- Smith & Wesson - M&P 2.0 Competitor Metal 9MM 5" Barrel Tungsten - 17Rd

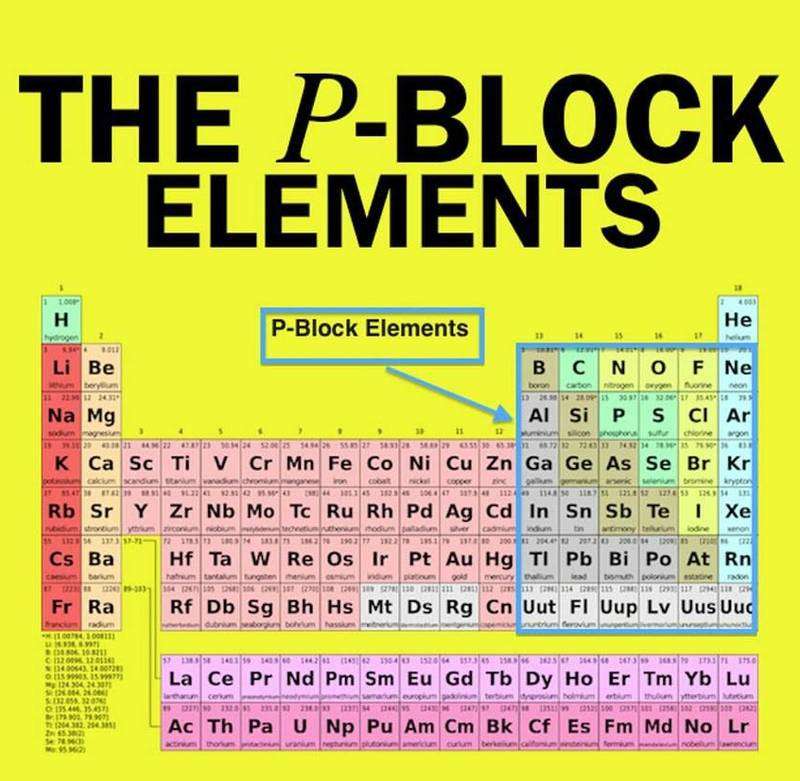

- P Block elements notes for Neet - StudiGoo

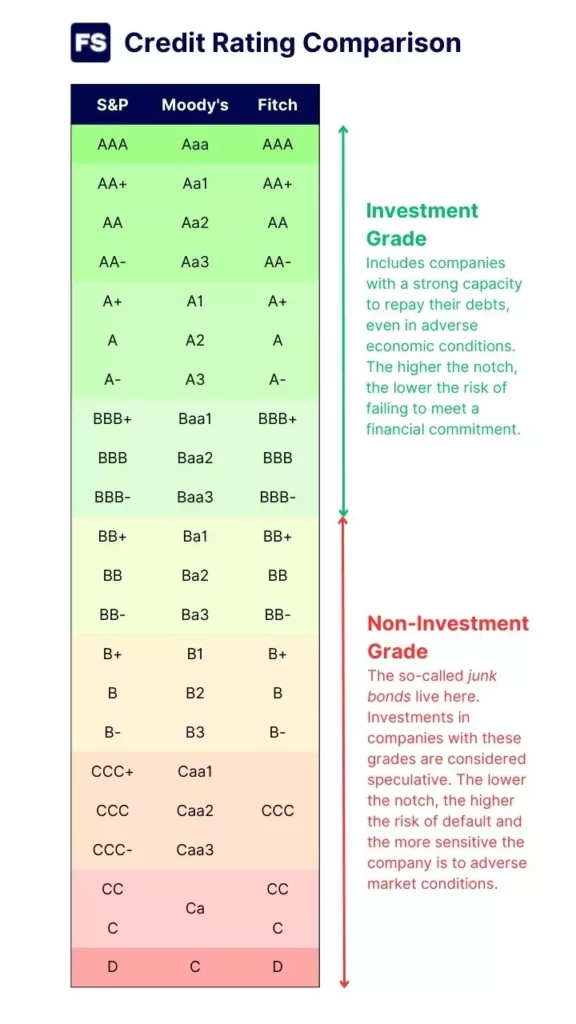

- S&P vs. Moody's vs. Fitch: Rating Conversion Chart (Updated)

- S P 500 Annual Returns Chart - Ponasa

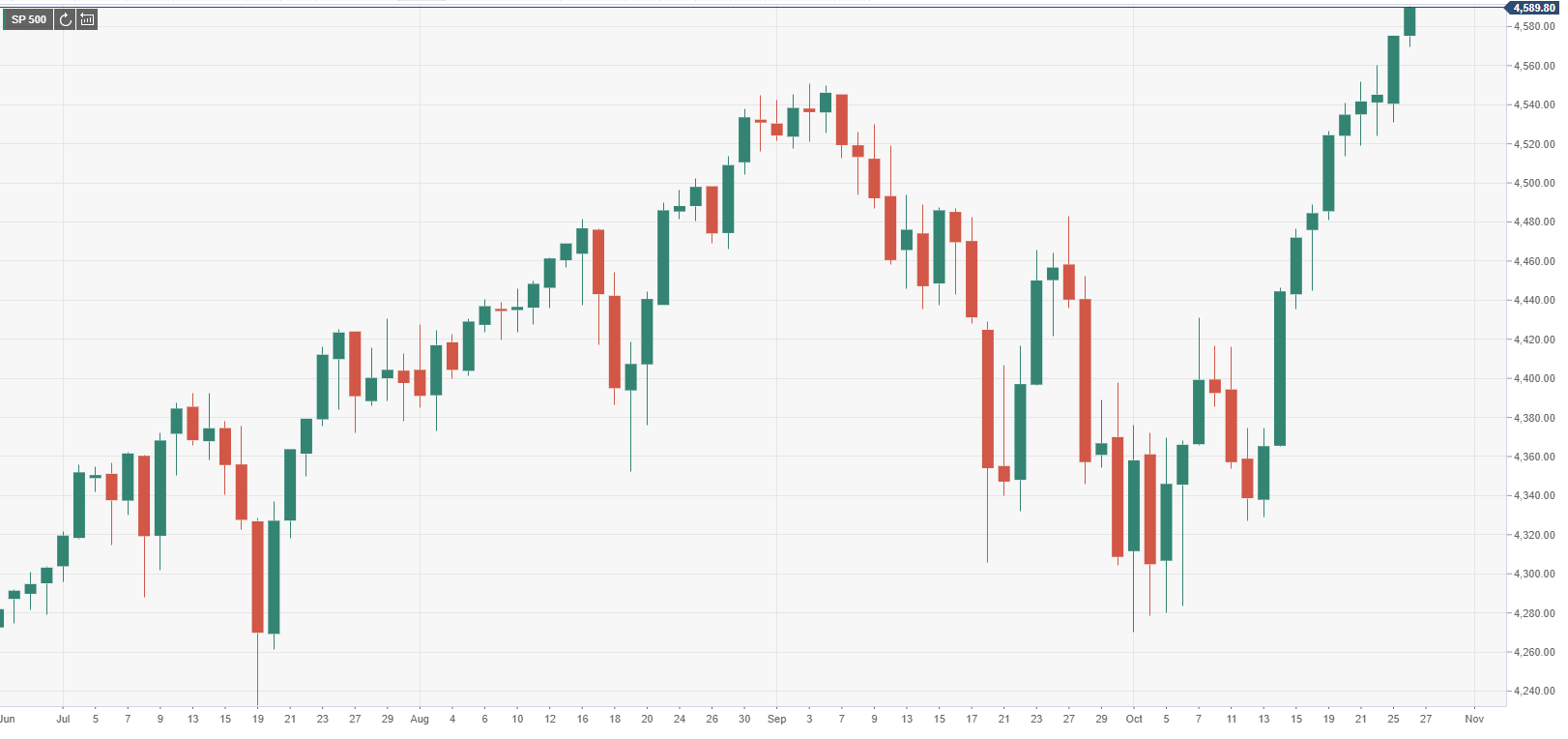

- S&P 500 z nowym rekordem! Dane historyczne pokazują, co teraz wydarzy ...

- S&P 500 Powers Through 4200 Amid Volatility Melt: Can It Overcome 4250 ...

- S&P 500 - TianahIndie

- S&P 500 Index notches new record-high after the opening bell

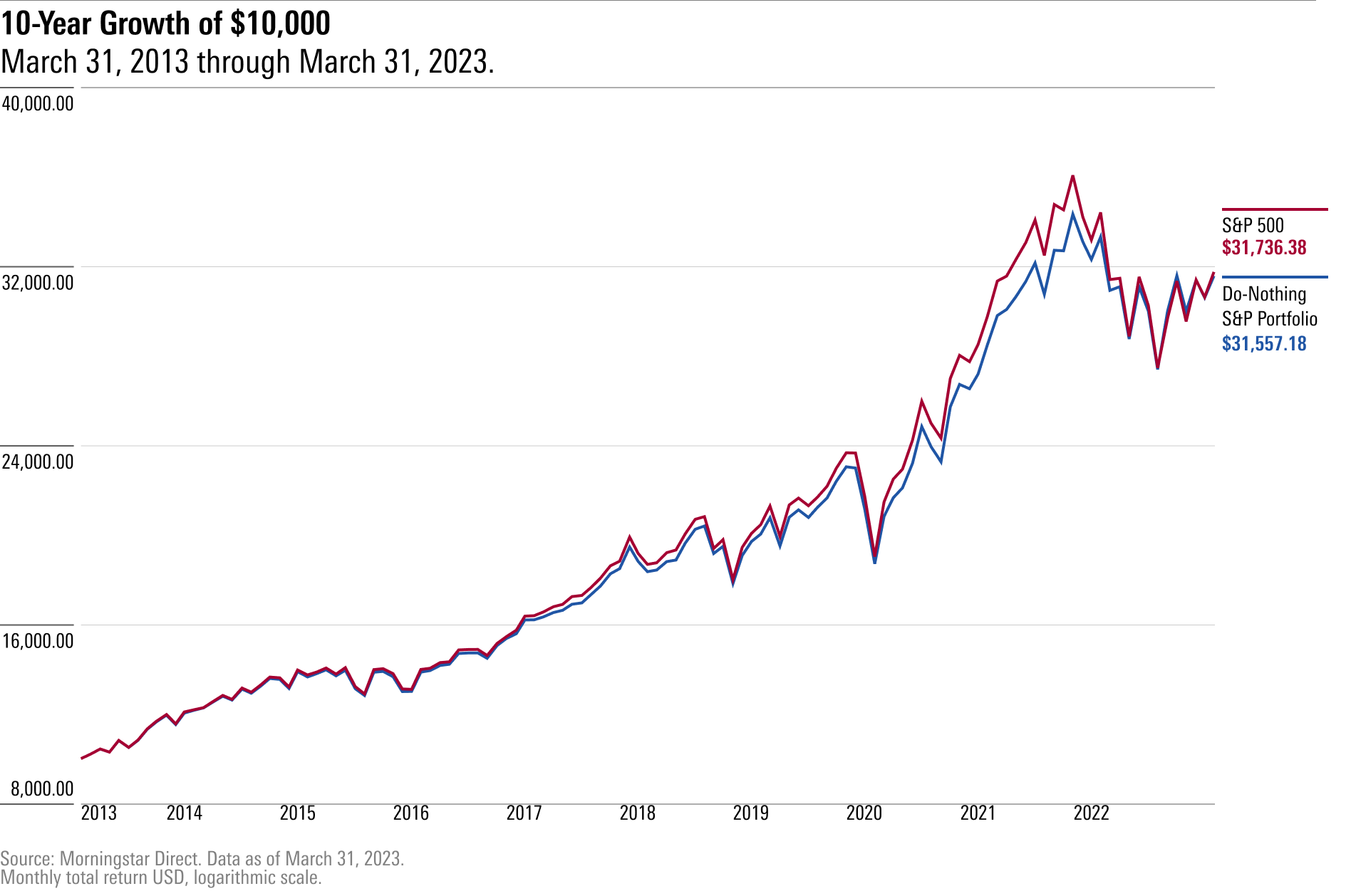

- Market Commentary: S&P 500 Index Hits a New All-Time High — Cultivate ...

- S&P 500 index to gold ratio: What does it mean and where might it go?

What is the S&P 500 Index?

How is the S&P 500 Index Calculated?

Why is the S&P 500 Index Important in Investing?

The S&P 500 Index is important in investing for several reasons: Benchmarking: The S&P 500 Index is widely used as a benchmark for the performance of the US stock market. It provides a way to measure the performance of a portfolio or a fund against the overall market. Diversification: The S&P 500 Index includes companies from a wide range of industries, making it a diversified investment option. Low Risk: The S&P 500 Index is considered a low-risk investment option because it is a broad market index that is less volatile than individual stocks. Easy to Invest: The S&P 500 Index can be invested in through a variety of financial products, including index funds, exchange-traded funds (ETFs), and mutual funds.

How to Invest in the S&P 500 Index

There are several ways to invest in the S&P 500 Index, including: Index Funds: Index funds are a type of mutual fund that tracks the performance of the S&P 500 Index. Exchange-Traded Funds (ETFs): ETFs are a type of investment fund that trades on a stock exchange like a stock. Individual Stocks: Investors can also invest in the individual stocks that make up the S&P 500 Index. In conclusion, the S&P 500 Index is a powerful tool for investors who want to gain exposure to the US stock market. Its importance in investing lies in its ability to provide a benchmark for the performance of the market, its diversification benefits, and its low risk. By understanding what the S&P 500 Index is and how it works, investors can make informed decisions about their investment portfolios and achieve their long-term financial goals.Keyword: S&P 500 Index, investing, stock market, US economy, benchmark, diversification, low risk, index funds, ETFs, individual stocks.